You can simply complete our Online Application Form.

After submitting your application, you will receive a confirmation email from us that will explain how to deposit funds and start trading.

Please contact us if you failed to receive the email.

You can open a free demo account easily through Demo Account page on our website. This will allow you try out the platform and your trading strategies.

We have a number of different trading accounts, please check Account Types page for details.

You can deposit fund by click here

For Chinese clients, we offer Alipay/Wechat Pay; Union Pay and International Wire Transfer.

You can withdraw your fund by click here.

It will take between 24-48 hours to process your application.

Please be aware that you can only withdraw your fund to the bank account under your name.

We offer many ways of deposit your fund. For domestic clients in New Zealand, direct internet bank transfer usually takes 1-2 hours to settle during business hours Mon-Fri.

Payments through Poli Pay settles the next working day.

Payments through Visa, Mastercard and UnionPay credit and debit cards, WeChat pay and AliPay typically take 1-2 hours inside business hours Mon-Fri.

Withdrawals and deposits overseas by back transfer (SWIFT transfer) can take between 2-4 days depending on the country, currency and your bank.

Please contact us if you need the payment to be applied urgently or payment has not been applied to your account yet.

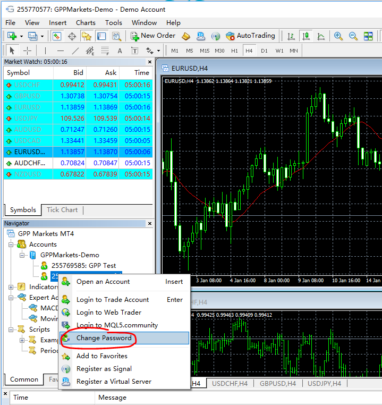

You can login to your trading account, under Navigator, right click your account number, there you will find an option to change the password.

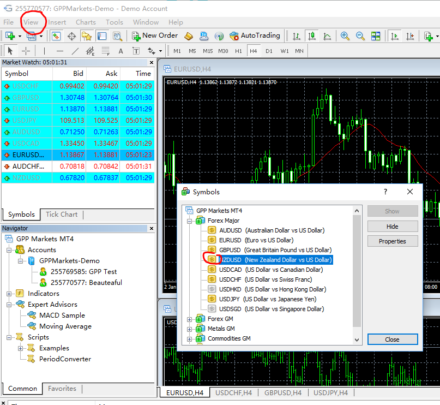

You will need to select the product with .GM and double click on it. (If the product you want to trade is not visible add it to your market watch list first)

Choose your volume, choose between ‘Market Order’, ‘Limit Order’, or ‘Stop Entry Order’, input the trade size and then hit enter. Optionally you can add any ‘Stop Loss’ and ‘Take Profit’ levels for limit and stop orders and then place your order. For more details please check our Risk Management page.

Please check Fees and Charges page.

We offer Contract for Difference (CFDs) on FX, Metals, Commodities, Indices.

For more information, please find our product schedule here.

We are constantly looking for the best spreads for you, please check Spreads page for more details.

At GPP markets we make sure that all your funds are kept separate from our operational accounts in a separate client funds account.

As a regulated Derivate Issuer License holder in New Zealand we follow all applicable Financial Markets Legislation, including the New Zealand client money regulations.This means client money is segregated from operational funds and checked on a daily basis and regularly audited by our financial auditor EY. We hold all our client funds in New Zealand at ANZ Bank.

Please check Money Safety page for more details.

On the menu bar, open View > Symbols, you will see all GPP Markets products listed, double click the product you want to add, and it will show on the main screen.

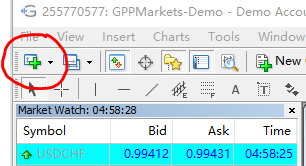

On the second line of the menu, click the first button with green + and to add new chart.

Leverage enables you to gain a large exposure to a financial market while only tying up a relatively small amount of your capital. In this way, leverage magnifies the scope for both gains and losses.

We only require you to deposit a small amount of margin to hold large positions, for most of our products the typical margin rate is only 1%.

Even though you only put up a relatively small amount of capital to open a position, your profit or loss is based on the full value of the position. Therefore, the amount you gain or lose could be relatively large compared to your initial outlay.

For more information please check our Trading page.

1. Losing more than the money in your account:

CFDs are leveraged meaning you only need to put up a fraction of your trade’s value to open it. So you could lose – or gain – much more than your initial deposit.

You can mitigate risk and lock in profits by setting an automatic stop or limit, to define the level you’d like your trade closed at.

2. Having your positions closed unexpectedly, resulting in you losing money.

You need a certain amount of money in your account to keep your trades open. This is called margin, and if your account balance doesn’t cover our margin requirements we may close your positions for you.

Keep an eye on your always-visible running balances in our platform or app and add more funds if they’re needed.

3. Sudden or larger-than-expected losses (or gains).

Markets can be volatile, moving very quickly and unexpectedly in reaction to announcements, events or trader behaviour.

As well as setting stops, you can also be notified of significant movement by setting a price or distance alert, giving you the choice of whether or not to react.

4. Having an order (an instruction you give us, to open or close a trade for you when the market hits a certain level) filled at a different level to the one you requested.

When a market moves a long way in an instant – or ‘gaps’ – any orders you have placed may be filled at a worse level than the one you requested. This is called slippage.

Check our Risk Management page for more details.

We aim to provide you with the best customer service at all times, however if you feel we have not met your expectations we want to hear from you.

Please check Complaints page to see how you can raise it with us.

GPP Markets was granted a Derivate Issuer License in New Zealand, this requires us to adhere to strict rules and regulations and means we are monitored by the Financial Markets Authority. The FSPR or Financial Service Provider Register is simply a register of financial companies in New Zealand, this is been abused by a number of overseas companies trying make out they have a license when in fact they do not. They are often not even based in New Zealand.

You should only deal with licensed companies and carefully check who you are dealing with as many unlicensed companies do not safeguard your money and are often simply scams.

For more information please check our Licensed and Regulated page.

GPP Markets is also a member of an independent dispute resolution scheme the Financial Services Complaints Limited (“FSCL”) our membership number is 6397. This is approved dispute resolution scheme under the Financial Service Providers (Registration and Dispute Resolution) Act 2008.

GPP Markets Ltd is a company registered in New Zealand (NZBN 9429042010807) located at Level 21 191 Queen Street, Auckland; PO Box 5382, Wellesley Street, Auckland.Phone: +64 9 281 2012 email: info@gppmarkets.com. GPP Markets Ltd is a registered Financial Service Provider (FSP509766) and holds a Derivative Issuer Licence issued by the Financial Markets Authority.